Summary

RBN is the governance token of the Ribbon Finance protocol and is used to vote on decisions pertaining to the protocol. But it is just that - a governance token. We want to tightly couple the success of the protocol with the success of RBN, and vice versa, by providing utility to RBN.

Introducing veRBN, Ribbon’s adaptation of Curve’s successful and battle-tested veCRV tokenomics model [1].

In addition to current voting power, RBN will have the following additional utility:

- more RBN staked = more $RBN rewards user receives on their staked vaults tokens a.k.a boosting

- more RBN staked = more voting power on redirecting liquidity mining rewards to the vault gauge user is staked in

- more RBN staked = higher share of the protocol revenue (will be introduced after initial launch)

Before proceeding, please read our Ribbonomics [2] article for context. Note we have abandoned the “protocol backstop” from the article.

Proposal

This new “ribbonomics” architecture impacts two groups:

- Options vault depositors

- RBN stakers (veRBN)

Vault Depositors

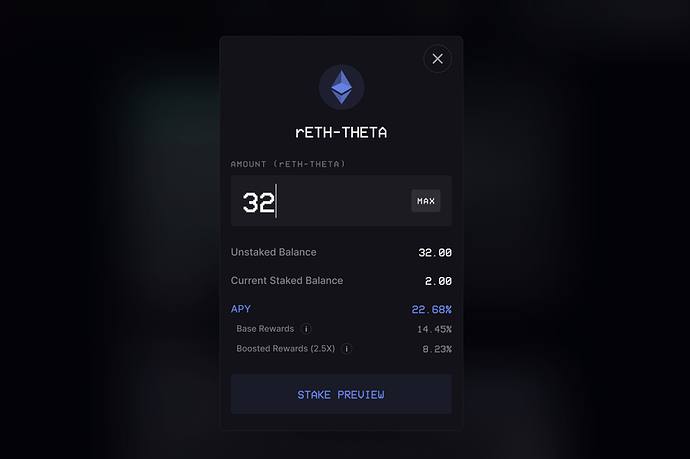

Vault depositors will be able to stake their vault tokens (ex: rETH-THETA) in a gauge and earn $RBN. As an example, vault staking in the ETH covered call vault goes as follows:

- Deposit ETH into the covered call vault

- Wait until the upcoming Friday which is when new funds will be collateralized. You will have nothing to stake beforehand

- Stake rETH-THETA shares in the rETH-THETA gauge and receive rETH-THETA-gauge tokens.

Given the proposed emission schedule (later in the proposal) and assuming equal distribution between all vaults across all chains, the APY % will look roughly as follows.

The exact % APY you will be earning will depend on (1) vault gauge reward allocation for the vault you are staking in (2) individual RBN balance.

RBN Stakers

In addition to both RBN holders and veRBN holders being allowed to vote on governance proposals such as this, RBN stakers will have four new powers: boost $RBN rewards earned on staked vault tokens, delegate boosts, voting power on $RBN reward distribution amongst vaults, and higher share of protocol revenue.

RBN stakers will have the choice to stake their RBN anywhere from 1 week to 2 years. The longer you stake the more power you have on all fronts.

Boosting

In the Curve ecosystem, as a veCRV holder I can boost the rewards I earn on any gauge I deposit into up to 2.5x. For example without veCRV holdings a curve stETH-ETH LP gauge staker might earn $100 in CRV. But depending on their veCRV balance they could be earning as much as $250, or a 2.5x multiplier. This is what’s called “boosting” [3]. You can read a concise guide here as well [4].

We will have this as well, except instead of a liquidity pool gauge, we have options vault gauges.

Boosting Delegation

RBN stakers will have the flexibility to delegate their boosts to other users if they so choose. They can either do this for altruistic purposes, or more likely, for bribes. Imagine that you don’t want any exposure to the options vaults so you are not staking vault deposit tokens. But you have staked your RBN. You will be able to delegate your boost to others who are staking vault deposit tokens and receive some reward from them for doing so. This allows you to reap all the benefits of staking RBN without having to actually deposit into the vaults.

Gauge Weight Voting

As a veRBN holder, similar to veCRV holders [5], you will be able to vote on RBN distributions to the respective options vault gauges. This is extremely powerful since you can vote to direct more RBN rewards to the vault you are staked in! Alternatively, similar to boosting you can accept bribes to redirect liquidity to a particular option vault gauge. Further details are in the Gauge weights section.

Protocol Fee Sharing

Ribbon Finance takes 10% performance fees and 2% management fees. For now, 100% of this is sent to the Ribbon treasury.

After we launch veRBN, we will begin discussing protocol fee sharing in which some % of protocol revenue will be redirected to RBN stakers pro-rata. This is exactly what Curve does except instead of redirecting profits from option premiums it redirects profits from LP fees [6].

We are thinking about two approaches:

- Take the performance/management from all the vaults (ETH, WBTC, USDC) and buy back RBN from the market and distribute that to veRBN holders. On one hand this creates constant buy-pressure on RBN similar to xSUSHI. On the other hand if RBN is not doing well, the profit sharing APY will be low.

- Take the performance/management from all the vaults (ETH, WBTC, USDC) and convert it to stablecoins and distribute that to veRBN holders for reliable cash-flow. On one hand this provides reliable returns. On the other hand, there is less buy pressure for RBN on the market.

RBN emission schedule

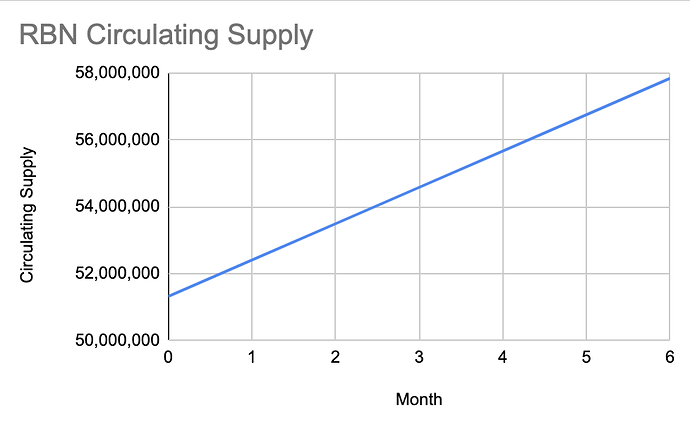

The current RBN circulating supply today (as of Feb 8th) is

51,318,849 RBN.

We propose an emission schedule of a constant 250K RBN per week over the course of 6 months. This is ~6.5M RBN overall, or 0.65% of total supply.

We feel this is an optimal emission schedule to provide just enough RBN rewards in addition to our existing sustainable yield. This will draw in new users without diminishing marginal returns in over-rewarding, which will attract more mercenaries.

Regardless, we always have the flexibility to adjust the emissions per week either higher or lower, given sufficient support from RBN and veRBN holders of course. After 6 months, assuming no changes until then, we will officially revisit the emission schedule in a new proposal.

Note that the current emission schedule has been simplified to focus only on RBN entering circulation from emissions. This does not include team and investor unlocks that will happen starting from May, halfway through the current emission schedule proposal. For more details please read RGP-3 [7].

On-chain Gauge System to determine Liquidity Mining distribution

As mentioned earlier, veRBN holders have the power to vote on gauge weights, or RBN reward distributions. For example, let’s say the rETH-THETA staking gauge has 25% allocated to it in RBN rewards out of the total emission that week. A veRBN holder can choose to increase the allocation by voting for that gauge on a weekly basis. He might choose to do so for several reasons, including bribes from other vault stakers or he himself is a staker in the ETH covered call options vault gauge.

As a result, the APY’s for each options vault gauge will change accordingly based on reward distributions. One week the APY for the ETH covered call vault gauge might be 50% of all emissions, and the next it could be 35%. This means less APY for that vault during that week.

Gauge types

There are different gauge types that are used in the ve system, each type gets a fixed percentage of the RBN supply minted weekly. Within each gauge type there can be many gauges that share the amount of RBN sent to that gauge type. The following gauge types and weights are proposed:

- Ethereum mainnet options vaults: 100% (250,000 RBN / week)

New gauge types can be added and the weights/percentages of all gauge types can be changed by governance. We will shortly be voting to add Avalanche and Aurora gauge types alongside Ethereum mainnet.

Initial gauges

At launch, we will add gauges for all existing mainnet options vaults:

- Covered Calls: BTC, ETH, stETH, Aave

- Put selling: yvUSDC

We will initially disable voting by veRBN holders for a more gradual launch and instead will snapshot the gauge weights based on TVL on Feb 23rd:

Upgrading the system

We have the optionality to unlock all locked RBN ahead of the max 2 year lock. If we find the current system does not work for the Ribbon Finance protocol and community further down the line, no matter how unlikely, we will have the option to abandon it if the community agrees.

Given the speed of change in DeFi, being able to change our minds about something as fundamental as the tokenomics model is crucial to remain vigilant, especially in a space as competitive as DOV’s. We think we can maximize tokenholder value this way over having an immutable tokenomics architecture and predictable emission schedule for years to come.

Conclusion

The veRBN aims to achieve several things:

- Long-term alignment. By locking RBN, we incentivize long-term support over short-term speculation.

- Grow TVL. By incentivizing vault depositors, we intend to grow our user base and total value locked.

- Composability with other protocols. This will incentivize several other protocols like Yearn and Convex (and many more) to build on top and interoperate to create a flourishing Ribbon ecosystem. This will increase our distribution channels, innovation, and scarcity for RBN.

Launch

To have a controlled and gradual release, we will unlock features of the veRBN architecture in phases instead of all at once.

Phase 1

Immediately after this proposal passes we will have:

- LM rewards for vault depositors (with initial gauge weights)

- RBN staking boosting

Phase 2

One month after launch we will have:

- Boosting Delegation

- Gauge Voting

Phase 3

Protocol Fee Sharing. Release is TBD

EDIT

We have listened to the community and have decided to make two changes to the

existing proposal:

-

veRBN withdrawal penalty. Originally, if a user wanted to lock RBN for two years they would be unable to withdraw it earlier. Now, users can unlock their RBN whenever they want at the cost of paying a penalty. The penalty is calculated by taking the minimum between .75 and (time left until unlock) / 2 years. For example if you have 1 year left on your lock, the penalty is min(.75, 1/2) = 0.5. So the penalty is 50%. All penalties will be redistributed to the remaining lockers pro-rata. This is identical to the dynamic implemented in the veYFI proposal [8].

-

Retroactive protocol revenue. Protocol revenue will be retroactively rewarded based on when veRBN locking initially opens up. So somebody who locks at the beginning will earn more of the protocol rewards than somebody who locks right after protocol revenue is implemented, all else being equal. This rewards rbn lockers protocol revenue from day one, albeit rewards are available in phase 3.

We will keep this proposal open for another two days to discuss the changes, after which voting will be open on Snapshot for three days.

Voting

The snapshot vote will be a single choice vote. You may vote on the proposal by selecting “Yes, let’s do it” or “No, this is not the way”.

Thanks to Curve dev team and Michael Egorov for feedback, also thank you to Curve for having created this great tokenomics system and also to Balancer [9] for inspiration for this proposal!

References: